All Categories

Featured

Table of Contents

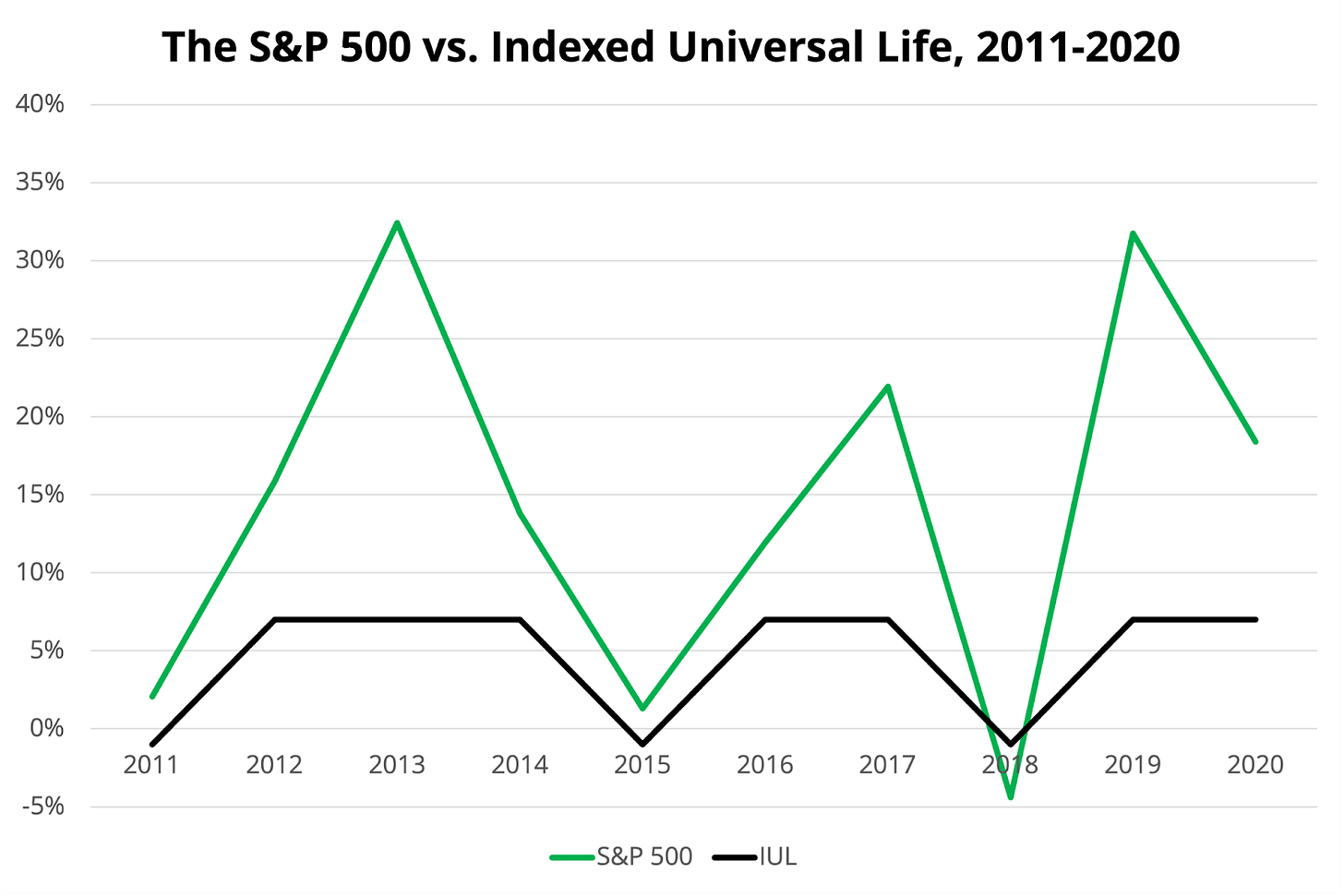

In exchange for earning a minimal amount of the index's development, the IUL will certainly never get less than 0 percent passion. Also if the S&P 500 declines 20 percent from one year to the following, your IUL will not shed any type of cash money value as a result of the market's losses.

Visualize the passion intensifying on a product with that kind of power. Offered all of this info, isn't it conceivable that indexed global life is a product that would permit Americans to acquire term and spend the rest?

A real financial investment is a protections item that is subject to market losses. You are never based on market losses with IUL merely because you are never based on market gains either. With IUL, you are not invested in the market, however just earning rate of interest based upon the performance of the market.

Returns can expand as long as you continue to make payments or maintain an equilibrium.

Universal Life Insurance Vs Term Life

Unlike global life insurance policy, indexed global life insurance coverage's money worth earns rate of interest based on the efficiency of indexed stock markets and bonds, such as S&P and Nasdaq., states an indexed global life policy is like an indexed annuity that really feels like universal life.

Due to these features, irreversible life insurance policy can function as an investment and wealth-building device. Universal life insurance policy was produced in the 1980s when rates of interest were high. Like various other sorts of permanent life insurance policy, this plan has a cash worth. Universal life's money value gains passion based upon present cash market prices, but rate of interest rise and fall with the marketplace.

Indexed global life plans use a minimal surefire passion price, additionally referred to as an interest attributing floor, which lessens market losses. For instance, say your cash worth loses 8%. Numerous business provide a flooring of 0%, suggesting you won't shed 8% of your financial investment in this case (iul training). Be conscious that your cash worth can decline also with a flooring because of costs and other expenses.

Maximum Funded Life Insurance Contract

It's additionally best for those ready to presume extra threat for higher returns. A IUL is a permanent life insurance coverage plan that obtains from the properties of an universal life insurance plan. Like global life, it permits versatility in your fatality benefit and costs payments. Unlike global life, your cash value expands based upon the performance of market indexes such as the S&P 500 or Nasdaq.

Her job has been published in AARP, CNN Highlighted, Forbes, Ton Of Money, PolicyGenius, and U.S. News & Globe Report. ExperienceAlani has actually evaluated life insurance policy and animal insurance provider and has actually composed various explainers on traveling insurance, credit, debt, and home insurance coverage. She is passionate concerning debunking the intricacies of insurance and various other individual finance subjects to make sure that visitors have the information they need to make the best cash decisions.

Paying just the Age 90 No-Lapse Premiums will certainly ensure the survivor benefit to the insured's achieved age 90 but will certainly not ensure cash worth accumulation. If your customer ceases paying the no-lapse guarantee costs, the no-lapse function will certainly terminate before the guaranteed duration. If this occurs, additional premiums in an amount equivalent to the shortfall can be paid to bring the no-lapse attribute back active.

Insurance Coverage (IUL) was the ideal thing considering that sliced bread.

Iul Death Benefit

First a short explanation of Indexed Universal Life Insurance Policy. The destination of IUL is obvious. The facility is that you (virtually) obtain the returns of the equity market, without any danger of losing cash. Now, prior to you fall off your chair poking fun at the absurdity of that declaration, you need to understand they make a very persuading debate, at the very least until you look at the information and understand you don't obtain anywhere near the returns of the equity market, and you're paying much excessive for the warranties you're obtaining.

If the market decreases, you obtain the ensured return, normally something between 0 and 3%. Certainly, considering that it's an insurance plan, there are also the normal costs of insurance coverage, commissions, and surrender costs to pay. The details, and the reasons that returns are so awful when mixing insurance coverage and investing in this specific way, come down to essentially three things: They only pay you for the return of the index, and not the rewards.

Universal Underwriters Life Insurance

Your optimum return is topped. If you cap is 10%, and the return of the S&P 500 index fund is 30% (like last year), you obtain 10%, not 30%. Some plans just give a specific percentage of the adjustment in the index, say 80%. So if the Index Fund rises 12%, and 2% of that is dividends, the modification in the index is 10%.

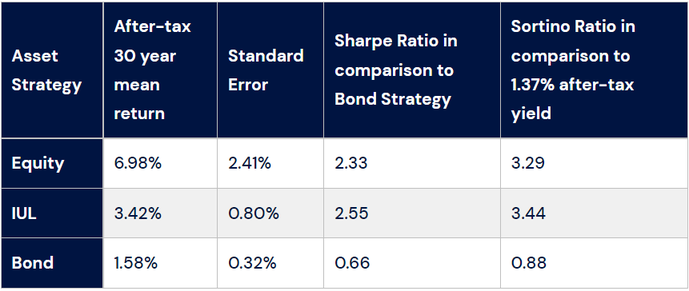

Add all these impacts with each other, and you'll locate that long-term returns on index universal life are pretty darn near those for entire life insurance policy, favorable, but low. Yes, these plans ensure that the cash worth (not the cash that goes to the expenses of insurance coverage, obviously) will not lose cash, but there is no warranty it will stay on top of inflation, a lot less expand at the price you require it to grow at in order to provide for your retirement.

Koreis's 16 factors: An indexed universal life plan account value can never lose cash due to a down market. Indexed universal life insurance policy assurances your account worth, locking in gains from each year, called a yearly reset.

In investing, you obtain paid to take threat. If you don't desire to take much threat, don't anticipate high returns. IUL account worths grow tax-deferred like a certified plan (individual retirement account and 401(k)); mutual funds don't unless they are held within a qualified strategy. Basically, this indicates that your account worth gain from triple compounding: You earn rate of interest on your principal, you gain rate of interest on your rate of interest and you make interest accurate you would certainly or else have actually paid in tax obligations on the rate of interest.

Universal Life Insurance Cons

Although qualified plans are a better choice than non-qualified strategies, they still have concerns absent with an IUL. Financial investment options are typically restricted to mutual funds where your account worth undergoes wild volatility from exposure to market threat. There is a large difference between a tax-deferred pension and an IUL, however Mr.

You purchase one with pre-tax dollars, reducing this year's tax obligation bill at your low tax obligation price (and will usually be able to withdraw your cash at a lower efficient rate later on) while you buy the other with after-tax dollars and will be required to pay interest to obtain your own money if you don't want to give up the plan.

After that he tosses in the timeless IUL sales person scare tactic of "wild volatility." If you hate volatility, there are far better means to reduce it than by purchasing an IUL, like diversification, bonds or low-beta supplies. There are no limitations on the quantity that might be added yearly to an IUL.

:max_bytes(150000):strip_icc()/pros-cons-indexed-universal-life-insurance.asp_v1-e119226901bc464593a496c003551ea0.png)

Why would the federal government placed limitations on just how much you can place into retirement accounts? Perhaps, just maybe, it's due to the fact that they're such a great offer that the federal government doesn't desire you to conserve also much on tax obligations.

Latest Posts

Guaranteed Universal Life Insurance Rates

Universal Life Insurance Cash Value Calculator

Ffiul Insurance